The COVID-19 pandemic has accelerated the growth of e-commerce share in global retail. Amazon, which may serve as a showcase for digital retail, has faced a 40% sales growth since the outbreak’s beginning.

But what exactly does the e-commerce boom mean for retailers? First and foremost, the offline-only retail model becomes too risky forcing more and more players to start selling online. And even if you are an experienced online retailer, you must beware of dozens of new players entering the market each week or month eager to get a part of the market share. Now, let’s look at five practical tips that would help retailers of all types to secure their online sales.

Table of Contents

1. Reconsider the growth engine of your business

The right choice of a growth engine model is a crucial factor underlying a retailer’s success in either moving online or securing the already gained market share. While setting up the growth engine model, retailers must consider their business maturity level, resources available, and strategic goals. For example, in the early stages of business lifecycle, retailers should focus mainly on boosting awareness (e.g. by means of extensive advertisement campaigns) and distribution of their products. These two factors should also define the growth engine model in case a retailer has started selling online only recently.

Those retailers that have already asserted themselves in the e-commerce segment should seek sales drivers elsewhere. As the initial growth plateau is reached, the effective assortment management practices and enhanced pricing policy come into play. At this point, crafting an optimal and the most relevant value offering becomes a crucial sales driver.

It means that a retailer with an already gained market share can secure its positions by offering a better proposal than competitors. The latter is done primarily by means of pricing. Covering major pricing segments, being aware of every role a particular SKU plays in your portfolio, sustaining optimal price positioning — these things can help to secure online sales share.

Growth Engine During the Crisis

Notably, the growth engine models outlined above may change in the time of crisis. For example, during the lockdown, the retailer’s ability to supply and deliver the needed quantity of products becomes very important. The point is that you cannot choose one particular growth engine model and use it at every stage of the business lifecycle. Now, when everyone starts selling online, retailers should start reconsidering their growth engine on a regular basis to make sure the right tools are used at the right moment.

2. Make the commercial triad work for you

Now, let’s talk about how the commercial triad may change when everyone starts selling online. The commercial triad includes the three sales drivers we’ve already mentioned above. These are relevance (i.e. pricing and assortment), availability (i.e. distribution), and awareness (i.e. PR and advertisement). Now, how do these drivers work normally? Of course, the accurate numbers might be different depending on the industry type, product range, and several other factors. But, in general, the return on investment (ROI) in each of the sales drivers works as follows:

- 1% change in price usually results in up to a 3% change in sales

- 1% change in distribution generally brings a 0.7% change in sales

- 1% change in advertisement can generate a 0.05% change in sales

These dependencies are the high-level illustrations of how a commercial triad works under conventional circumstances. Today, the global economic turbulence provoked by the COVID-19 pandemic has mixed everything up. So, how the commercial triad has changed, and what can retailers do about it?

In the time of crisis, the advertisement plays a rather insignificant role as a sales driver. Media and PR activities become less likely to bring the expected results if only you are not selling the essential health-safety products. However, the advertisement activities are worth being fully recovered just as the retail and other industries will get back to normal life again.

Another important change stems from the fact that the demand for particular products soars and, therefore, the absolute impact distribution has on sales soars too. Here’s an example: if most of the consumers used to buy footwear in the brick-and-mortar stores, they are now extensively moving online. What it means is that footwear online sales increase drastically which requires additional investment in distribution and delivery services.

Finally, the relevant price attractiveness becomes a crucial sales driver within the commercial triad. As more and more players start selling online, price transparency also increases. Shoppers can easily compare prices while making purchases which makes a competition-based pricing strategy the most relevant approach, especially for the KVI and Best Price Guarantee (BPG) products.

3. Be the last to increase prices

So, in the time when everyone starts selling online, pricing becomes a crucial sales driver with the competition-based strategy being one of the most relevant approaches. Competition games play a decisive role, especially, for the essential categories of products.

In many markets across the globe, the recent crisis has led to currency fluctuations which, in turn, provoke high inflation rates. Together with the multiple supply chain challenges, these factors make the price increase an almost invertible step. What it means is that retailers across the industries are getting involved in the price increase delaying games.

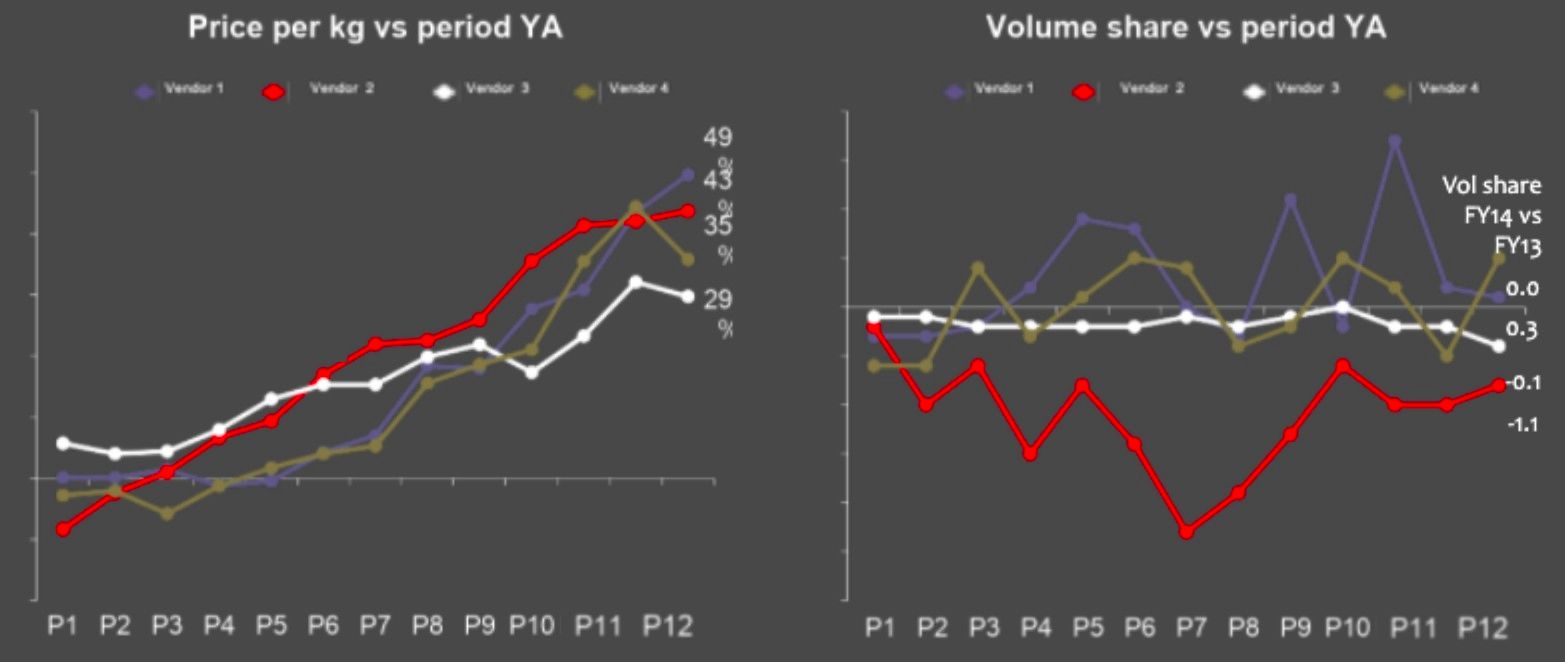

The visual illustrates how the chocolate producers operating on Ukainian market managed to sustain volume share by being the last to increase prices during the 2014 crisis

To win these games and outperform rivals, you have to be the last retailer to increase the price. Increasing prices a month or even a couple of weeks after competitors is the most sustainable way to secure your market share in the times of severe competition.

Of course, those retailers that increase prices with no regard to the other players are likely to have some sort of short-term revenue uplift. But what is at stake is the customer loyalty and the overall financial health. In other words, being the last retailer to increase prices is a good illustration for the case when strategic and long-term benefits outweigh significantly the short-term boost in profit and revenue.

4. Identify your true competitors

In some market segments, there are only a few players that compete with each other for years. Of course, identifying the real competitors is not a problem in such a case. However, the very limited number of sellers becomes a rather rare case that is not relevant for most of the products across the industries. When everyone starts selling online and dozens of new retailers go into e-commerce weekly, tracking competitive landscape might become a real problem.

The importance of identifying your true competitors should never be disregarded, especially in case the competition-based pricing strategy is used. We’ve just talked about how important it is to be the last among the competitors to increase the price. But if the same product is offered by 40 or 70 online retailers, should you track each of them to make sure your price is the most attractive?

The answer is definitely no. Tracking dozens of competitors would not only take too much financial, time, and human resources but may even have a negative impact on your sales due to the risks of following false competitors and getting involved in the endless price wars and ‘races to zero’.

The good news is that, in most cases, there are only up to 5 competitors having a real impact on your sales and, therefore, are worth following. The question is how to find out what are the 5 true competitors among dozens of fake ones. And that’s where advanced AI-driven pricing software can help. By means of analyzing competitive and historical sales data, advanced algorithms can easily define the impact every player has on particular product sales.

5. Watch the absolute price points and price thresholds

Even though you should always try to be the last to increase prices among your true competitors, the very process of raising prices is inevitable. And here is a point to remember: the way retailers increase prices is not less important than the choice of the right timing for a price change. In other words, there is no point in being the last to raise prices if the new price is too high and unacceptable for the shoppers. So, how to increase prices wisely?

The absolute price points and price thresholds are those tools that can give the answer. To put it simply, every price per particular product belongs to a certain psychological category. That’s how particular prices are marked by customers as cheap, medium segment, expensive, etc.

The visual shows the typical pricing thresholds lines separated by ‘magic price points’

To put it simply, these psychological categories are the price thresholds. The points separating these price thresholds are actually the absolute price points. The retailer’s goal is to increase prices without crossing the absolute price points and, eventually, moving into another threshold. The question is how to identify the price points and thresholds?

Perhaps unsurprisingly, the best way to track absolute price points and price thresholds is to ask the customers directly. Today, there is no better means of identifying the price points than to run a customer survey. Running such surveys from time to time would not only help to keep your prices acceptable for buyers but would also reinforce the communication with customers contributing to their loyalty.

Conclusion

When everyone starts selling online and competition gets tougher every day, a few simple steps can help retailers thrive. Here’s a recipe: reconsider your growth engine on a regular basis, make sure the relevant price attractiveness is sustained, identify your true competitors, and be the last to increase prices but don’t forget about the magic price points. It’s time to make these things work for you.

About the author

Yulia Beregovaya is a pricing expert with more than 10 years of experience in Marketing Research and Analytics. Besides finding new ways pricing can boost the business, Yulia enjoys blogging and sharing insights on her recent findings.

Yulia Beregovaya is a pricing expert with more than 10 years of experience in Marketing Research and Analytics. Besides finding new ways pricing can boost the business, Yulia enjoys blogging and sharing insights on her recent findings.